- +91 9725410042

-

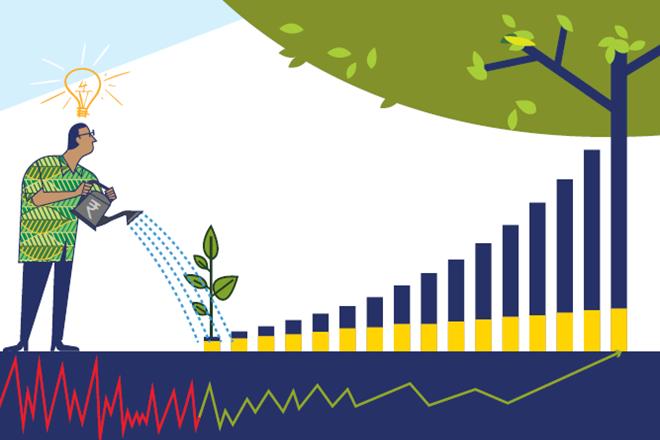

Knowing what is equity is of paramount importance before you start on your investment journey across stock exchanges in India. A company requires funds for its businesses and to meet its working capital requirements. To receive funds, it can resort to both debt and equity instruments. It can provide its shares or stocks through Initial Public Offerings (IPOs) to investors as part of raising funds through equities, or offer loan instruments with fixed interest rates, known as debentures.

Once a listed company offers its stocks to investors, these can be then traded – purchased and sold – in stock exchanges, like the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

The foremost benefit of trading in shares across stock markets is that you can become part- owners of the company. Every shareholder is a part-owner of the company, in direct relation to the shares owned.

Sign up to receive the latest news and promotions.

We are Distributors of Financial Products in India & NOT the Investment Advisors as per SEBI guidelines.

Mutual Fund Investments are subject to market risks. Please read all offer documents carefully before investing. There is NO Guarantee of any Returns in the Mutual Fund products.

"AMFI-registered Mutual Fund Distributor"

"ARN - 284652"

Date of initial registration 24th May 2004 valid till 26th Dec 2025

315, Pancham Icon,

Beside vasna DMart,

Vadodara - 390007

02652255191, +917622022853, +919725410042

Copyright © Pragati Funds 2021. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors