- +91 9725410042

-

Advances in medicine and surgery are helping us in treatment of illnesses and disorder better. Maintaining good heath is integral to build and realize your dreams. On the other hand, imbalanced lifestyles, pollution, use of chemicals in our food, increasing population density, has also increased the incidence of illnesses, diseases and accidents. The best option to face this challenge is prevention rather than cure. The second best and inevitable option is HEALTH INSURANCE.

Health Insurance is a cover that offers protection against financial losses one may incur in the event of illness, disease or accidents. It is a commitment by the insurance company to indemnify the policy holder against the medical expenses.

The medical inflation in India is well over double digits. The importance of Health Insurance can hardly be overemphasized. It helps you secure your goals against unforeseen eventualities. The financial loss can be even more damaging when the sole breadwinner of the family falls ill and the unfortunate even of his/her being incapacited to earn the situation can be very devastating , often resulting in bankruptancies forgoing the family’s goals, lowering of living standards.

IN very simple terms health insurance can be broadly classified as COMPENSATORY — wherein the policy holder is reimbursed the actual cost( with the limits of policy purchased) incurred in treating his or her medical condition — and BENEFICIARY -wherein the policy holder is paid the sum assured as per the policy conditions.The claim under BENEFICIARY policies is paid over and above or rather irrespective of the claim paid under a compensatory policy.

The commonly known “medical insurance’’ is normally a compensatory policy and is available in numerous variants in which the following elements have different permutations and combinations.

1.Sum Assured

2.Hospitalization Benefits

3.Room Rent Eligiblity

4.Non-Medical Charges

5.Outpatient Dept Charges

6.Deductible

7.Ambulance Charges

8.Limit per hospitalization

9.Pre-and Post Hospitalisation reimbursements

10.Daycare Treatment Charges

11.Cumulative Bonus

12.Restoration Benefits, maternity benefits, Waiting Period, Cooling Period, Continuity Benefit, Portability conditions and benefit, Top UP Cover

There can be some add-on benefits in the form of riders——-Waiver of cumulative Bonus Forfeiture, Hospitalization Daily Cash, Health Checkup, Health Returns, and other related benefits.

The BENEFICIARY POLICIES normally have a list of specified illnesses and conditions to be fulfilled.

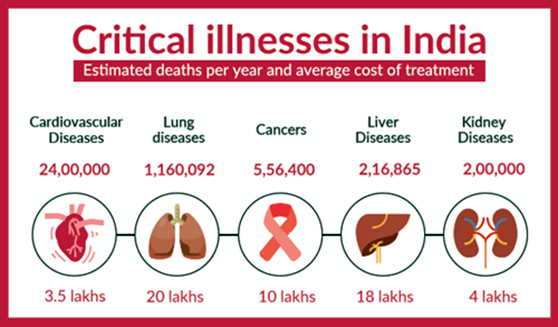

These illnesses normally are critical in nature/life threatening / require special care and costly prolonged treatment. They often affect a person’s lifestyle and earning capabilities and involve repetitive cash outflows. Some of the major critical illnesses prevailent in India, along with the average costs are shown here.:

Today the longetivity of an average Indian has gone up to 69.73 yrs (from 38 years in 1950)

However, the incidence of major diseases / critical illness has also gone up. Therefore the CRITICAL ILLNESS cover is now an essential element of your Financial Planning and Security.

Pragati Associates has been helping its patrons for the last 25 years in powering their Financial Goals and a major component of their services comprises of health insurance advisory, distribution, and after-sales services.

As a group of individuals, we are associated with Four major insurers Bajaj Allianz General Insurance Co, Aditya Birla Health Insurance, HDFC Ergo Health Insurance, Go-Digit General Insurance Co. We have a dedicated person to handle your claims.

For health insurance in Vadodara, you can call us on +919725410042.

So, a long experience, a satisfied clientele, dedicated personnel, and a variety of feature-rich products in our bouquet makes PRAGATI ASSOCIATES an obvious choice for your health insurance in Vadodara.

As a Vadodarian you are welcome to meet us at our conveniently located office, discuss your needs and feel secured after reposing your faith in our services. The policies can be purchased and renewed either offline or online depending on your convenience and comfort.

Sign up to receive the latest news and promotions.

We are Distributors of Financial Products in India & NOT the Investment Advisors as per SEBI guidelines.

Mutual Fund Investments are subject to market risks. Please read all offer documents carefully before investing. There is NO Guarantee of any Returns in the Mutual Fund products.

"AMFI-registered Mutual Fund Distributor"

"ARN - 284652"

Date of initial registration 24th May 2004 valid till 26th Dec 2025

315, Pancham Icon,

Beside vasna DMart,

Vadodara - 390007

02652255191, +917622022853, +919725410042

Copyright © Pragati Funds 2021. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors